Most foreign buyers think in dollars. But when it comes to real estate in Mexico, the smartest thing you can do is negotiate in pesos. Here’s why the difference matters more than you think.

Why Negotiating in Pesos Changes Everything

Buying property in Mexico is one of the biggest financial decisions you’ll make, and the currency you negotiate in plays a much bigger role than most people realize.

It might feel easier to talk in U.S. dollars, since that’s what you’re used to. But if you’re negotiating in USD while the deal is rooted in pesos, you’re giving up more than you think. From inflated prices to missed savings and hidden risks, the difference between pesos and dollars can quietly cost you thousands.

Let’s break down why starting your negotiations in pesos gives you the upper hand every time.

Developers and Sellers Add a Volatility Buffer to USD Pricing

When a Mexican developer or seller prices a property in U.S. dollars, they’re not just converting a peso price at today’s rate. They’re building in a cushion to protect themselves against currency swings. That buffer often inflates the USD price by 5 to 10 percent or more, just in case the exchange rate moves against them.

So when you agree to a price in dollars, you’re likely paying for that cushion.

Negotiate in pesos instead, and that buffer disappears. You’re working with the true price in local currency, often unlocking an instant discount.

You Leverage the Exchange Rate in Your Favor

When you negotiate in USD, you’re letting the seller set the terms and often, they’ve already padded the price to account for currency volatility. You’re also giving up the chance to benefit from a favorable exchange rate.

By negotiating in pesos, you flip that dynamic. You lock in the local price and put yourself in control of how and when to exchange your funds. This allows you to take full advantage of a strong dollar or favorable market conditions.

With the right strategy, you can:

- Maximize your buying power when the exchange rate works in your favor

- Lock in a great rate ahead of your closing date

- Capture savings the seller would otherwise keep for themselves

Instead of just reacting to the market, you’re using it to your advantage and that can translate to real savings.

Avoid Putting Your Developer in a Tough Spot

Another big reason to negotiate in pesos is to eliminate the currency risk from the developer’s side.

We’ve seen this happen with clients who negotiated a fixed price in USD. At the time, the number made sense and everyone felt confident. But when the peso strengthened significantly, the developer ended up receiving fewer pesos than expected. Even with a signed contract, the reality is this: they were suddenly working with a smaller budget.

This puts pressure on the project. Developers may be forced to cut corners, delay work, or quietly scale back on promises, not because they’re dishonest, but because the economics have shifted underneath them.

We always remind our clients to think of your developer as a partner. You want them to succeed. A strong project delivered as promised is in your best interest. It’s not just about locking in a price on paper. It’s about creating a situation where everyone can win.

Negotiating in pesos creates alignment from the start. It protects your costs and protects your developer’s ability to deliver. And that’s the kind of real estate deal everyone wants.

Unlock Additional Value with MexEdge

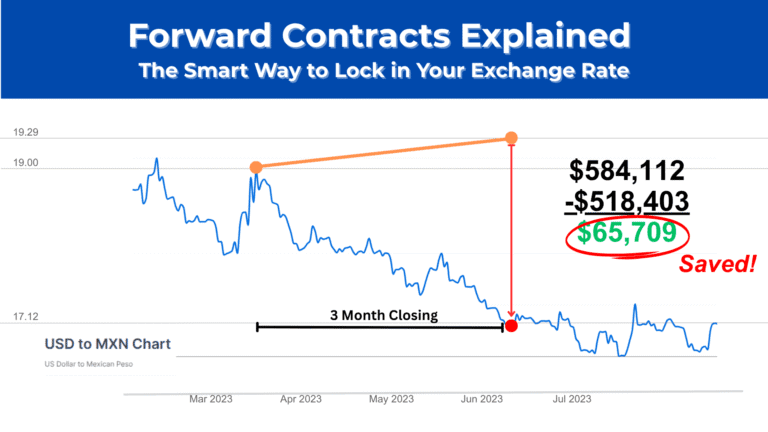

Negotiating in pesos also opens the door to a strategy many buyers don’t even know exists: locking in your exchange rate and earning forward points.

At MexEdge, we help expats and property buyers use tools like forward contracts to:

- Secure a favorable rate now, even if your closing is weeks or months away

- Eliminate currency risk from your deal

- Earn forward points that add additional value to your transaction

This means your property deal is no longer at the mercy of market swings. You know exactly what you’ll pay, with no surprises.

When USD Pricing Makes Sense

There are exceptions.

In some markets like Los Cabos, it’s not uncommon to see listings quoted in dollars, especially when the seller is also American. In these cases, a USD-to-USD deal can be simple and straightforward. Since both parties are dealing in the same currency, no exchange is required, which means there’s no risk from currency fluctuations during the transaction.

If you’re buying in dollars and the seller is receiving dollars, the price is fixed and unaffected by movements in the peso. In situations like this, staying in USD may be the cleanest path forward.

But in most cases, especially with Mexican sellers, developers, or local banks, pesos are the native currency of the transaction. And negotiating in pesos gives you far more flexibility and financial advantage.

Bonus Insight: All Official Documents Are in Pesos Anyway

Even when a deal is negotiated in U.S. dollars, all official paperwork such as appraisals, tax documentation, and the final deed is still processed in pesos. That means there will always be a conversion happening at some point in the process.

By negotiating in pesos from the beginning, you stay aligned with how the system actually works. You avoid unnecessary confusion at closing, and you eliminate any hidden surprises when numbers are finalized by the notary or bank.

The Bottom Line

Negotiating in pesos isn’t just about getting a better deal today. It’s about having full control over your costs, avoiding inflated prices, and protecting your investment from currency surprises.

If you’re thinking about buying property in Mexico, start the conversation in pesos. Then talk to us about how to make every dollar go further.

Want to explore how to lock in your rate and earn forward points? We’re happy to walk you through it. No pressure, just clarity.