Why Exchange Rates Matter for Foreign Buyers

Buying property in Mexico can be a smart move, but if you’re converting dollars or Canadian funds to pesos, the exchange rate can make or break your budget.

Take this year as an example. Since April 2025, the USD/MXN exchange rate has dropped from 20.85 to 18.91, a nearly 10 percent shift. If you were buying a 5 million peso property, that’s a difference of over $26,000 USD just from the market moving in a matter of weeks.

It’s one of the most overlooked risks in the buying process. And most don’t know there’s a simple way to eliminate the risk entirely.

What Is a Forward Contract?

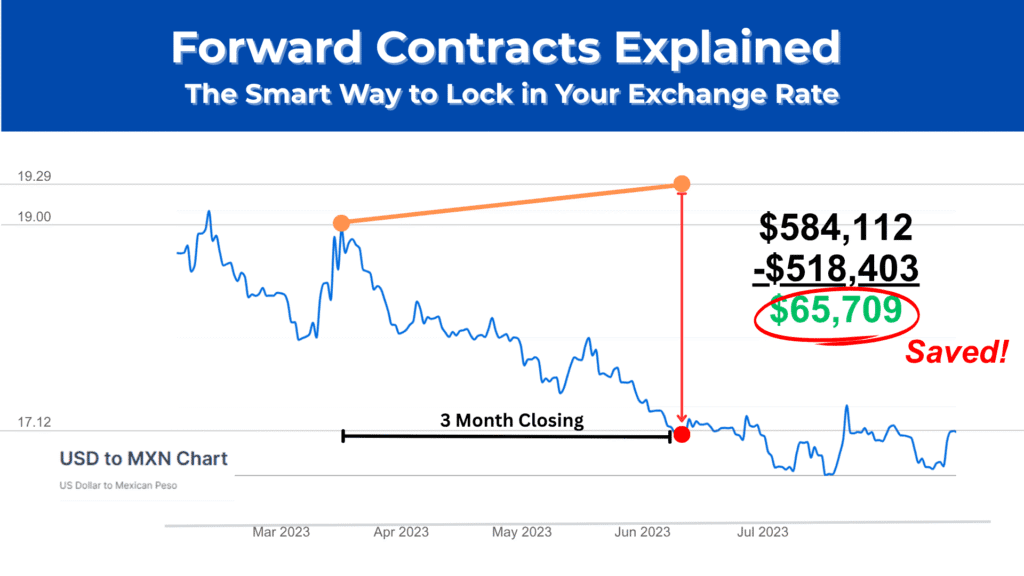

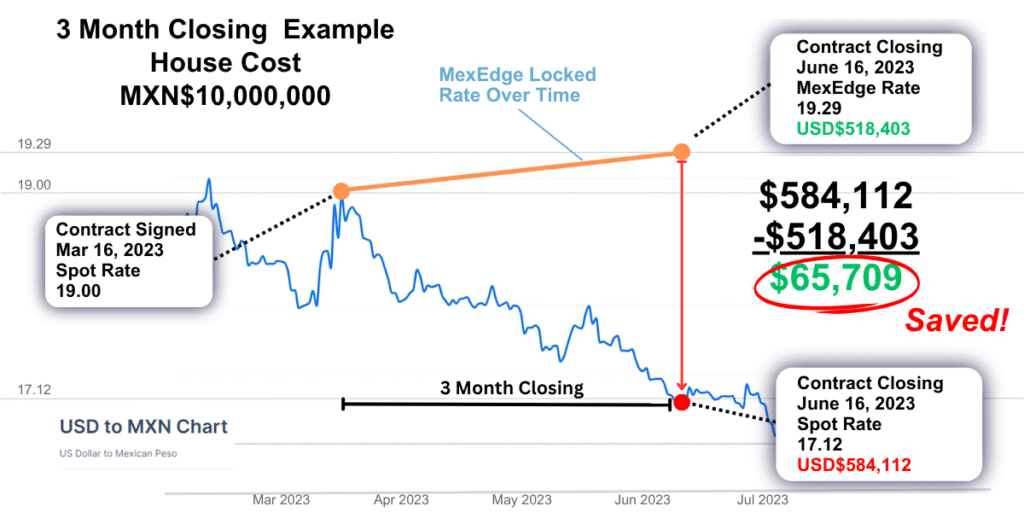

A forward contract is a simple financial agreement that lets you lock in an exchange rate today for a currency payment you’ll make in the future. These contracts are widely used in global trade and are considered one of the most basic tools in financial risk management. Businesses use them every day to protect against currency swings.

Thanks to MexEdge, individual real estate buyers can now access the same powerful tool.

Let’s say you’re closing on a property in six months, priced at 10 million pesos. If you lock in an exchange rate of 19.00, your total cost is $526,316 USD. But if the exchange rate drops to 17.50 before closing, that same property would cost $571,428 USD, a difference of over $45,000.

This is a hypothetical example, but it reflects the kind of market movement we’ve already seen this year. A forward contract lets you fix your exchange rate today so you’re not exposed to those swings.

With a forward contract, your price is fixed the day you sign. No surprises, no stress, and no exposure to market volatility.

Until Now, Forward Contracts Were Hard to Access for Individuals

Forward contracts have always existed, but for most individual buyers, they were nearly impossible to get. For years, they were reserved for corporations moving millions across borders. If you weren’t doing $50 million or more in annual volume, banks either wouldn’t offer them or made the terms too complex and expensive to be useful.

These contracts were designed for institutional clients, not everyday buyers trying to purchase a home in Mexico.

MexEdge changes that. We’ve made forward contracts simple, fast, and accessible. Whether you’re transferring $100,000 or $1 million, you now have access to the same high-quality exchange rates and financial tools previously reserved for large companies.

Now, individual buyers can protect their money with the same advantages global firms have relied on for decades.

The Power of Forward Points: The Exchange Rate Improves Over Time

When you lock in a forward contract through MexEdge, you’re not just freezing today’s exchange rate. You’re actually getting a better exchange rate the further out your contract goes.

This is thanks to a built-in feature called forward points, which reflect the interest rate difference between two currencies. You can think of it as interest you earn for committing early.

Depending on the currency pair, the exchange rate currently improves by 4 to 6 percent per year. So not only do you eliminate risk by locking in your exchange rate, you also save more compared to doing a last-minute spot trade at closing.

It’s a smarter way to move your money, and it rewards you for planning ahead.

The Smart Buyer’s Strategy

Using a forward contract isn’t just about risk protection. It’s about making the entire buying process smoother, safer, and more predictable.

With MexEdge, you can lock in your exchange rate with just a 10 percent deposit, even if your closing is months away. That means you can set your budget today and know exactly what your pesos will cost, no matter what happens in the currency market tomorrow.

If your payments are spread out, we can also structure tiered forward contracts, so each stage of your purchase or construction is protected at the right time and rate.

The best part? You earn forward points, like interest, on the entire amount, even though you’ve only deposited 10 percent. That means more savings and more value from day one.

No guessing. No gambling. Just clarity, confidence, and control from start to finish.

What If the Peso Weakens? (A Common Question)

One of the most frequent questions we hear is, “What if the peso weakens after I lock in my rate?”

It’s a fair question. But this isn’t about trying to time the market. It’s about protecting yourself from uncertainty.

If the exchange rate does improve later, you haven’t lost money. You’ve simply missed a potential opportunity. That’s called opportunity cost, not actual cost. What you pay doesn’t change.

This strategy is all about removing the risk of the downside. When you lock in an exchange rate, you eliminate the possibility of a sudden shift adding tens of thousands to your cost. That’s a win every time.

Most of our clients don’t care about chasing a slightly better rate. They care about knowing exactly what their home will cost, avoiding surprises, and sticking to their budget. When you’re wiring hundreds of thousands of dollars, that peace of mind matters more than trying to guess the perfect day to exchange.

Final Thoughts: Why This Is the Smarter Way to Pay for Property in Mexico

Forward contracts are one of the most effective tools for protecting your budget and bringing financial certainty to your purchase. They’ve been used by global businesses for decades, and now, thanks to MexEdge, they’re finally accessible to individual buyers.

You’re not just locking in a rate. You’re removing the stress of currency swings, earning interest-like forward points, and gaining clarity on what your property will actually cost in dollars.

Instead of hoping the exchange rate works in your favor, you’re taking control of the outcome. That’s not just smart. It’s essential when making a six or seven-figure investment in another country.

If you’re planning to buy or build in Mexico, don’t leave your budget exposed. Reach out to MexEdge and learn how a forward contract can protect your money and simplify your entire transaction.